If you want to open a Self-Directed Individual Retirement Account (SDIRA), you also need to choose an IRA custodian.

The custodian is a financial institution that holds your SDIRA’s investments and ensures the compliance of your account to all IRS and government regulations.

Features of the Best Custodians

All IRA custodians are not alike; there are variations. So, it makes sense to explore what features constitute the best custodian. Read on the following:

Wide Investment Options

The custodian that offers more investment options is better as you can select a wide range of investments. As an SDIRA holder, you need to look for non-traditional investment assets, like real estate, startups, precious metal, etc.

Low Fees

The lower the fee, the better it is. Fees are of various types that can include annual account maintenance fees, loads (for mutual funds), and commissions for making trades.

Good Customer Service

Excellent customer service is essential for you to get answers to all your questions. Therefore, the availability of specialists for servicing customers is necessary. It can be frustrating for you to receive incomplete or confusing answers to your questions.

User-Friendly Website

The custodian’s website should be user-friendly. It should be easy to use so that you can monitor your investments and make transactions without any hassle. You should also be able to navigate the website extensively.

Consolidation Savvy

If you have multiple SDIRA accounts, then you should consolidate them into a single account and custodian. As such, the custodian should be knowledgable about the rules regarding consolidation and understands which types of IRAs cannot be combined.

Restricted Investment Options

Custodians often tend to restrict your investment options. It is their style of functioning. But make sure that their restrictions are not the same as the IRS restrictions on IRAs themselves or rules-based in tax law.

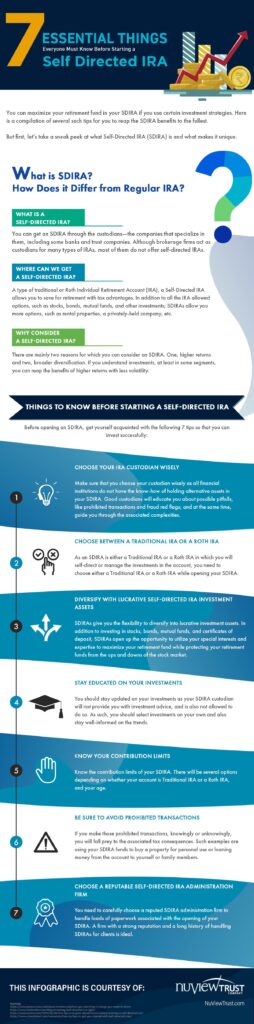

Having known the traits of a good custodian, you need to expand your knowledge to all the reasons for which you need to have an SDIRA. Refer to the infographic in this post to know those.